Accounts receivable follow-up is the workhorse of the revenue cycle process, functioning to clean up unpaid claims. Follow-up processes include reporting on the status of individual accounts; denial follow-up; payment discrepancy review; rebilling activities; secondary billing; and also credit balance research and adjustment.

While improving the effectiveness of front-end processes is significant, claim follow-up teams remain a necessary and effective method for protecting cash flow. Practices cannot afford many long-term outstanding receivables: they represent cash that could be used for paying bills or growing the company.

Issues facing Accounts Receivable (A/R) departments

- Denials: The source of a provider’s greatest financial exposure: all costs have been incurred, but payment remains outstanding. Typically more than 20% of invoices are outstanding for more than 120 days. This requires follow-up and resolution, demanding significant extra time and expense with no assurance that all appeals will be successful.

- Timely filing: Claims pending the longest are in the greatest danger of not being paid because they may have passed timely filing deadlines. Ignorance of carriers’ filing deadline policies makes it difficult to prioritize claims handling. The result? Greater risk of delayed payment or nonpayment.

- Carriers demand more information: Coding or payer contract issues may result in requests for more information; these must be tracked and pursued efficiently.

What NDS will do?

In broad terms, NDS will:

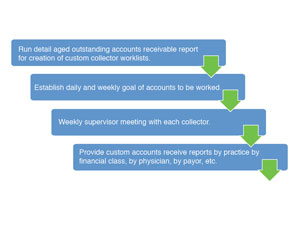

- Produce detailed aging schedules of Accounts Receivable to enable creation of custom worklists that are then assigned to specific collectors.

- Based on these worklists, establish daily and weekly goals of accounts to be worked.

- Provide custom accounts receivable reports broken down by filing limit to assist prioritize long-overdue accounts with tight deadlines. (These reports may also be segmented by practice, by financial class, by physician, and by payer to facilitate followup with specific stakeholders.) Dedicated teams are assigned to handle high-dollar, high-risk accounts.

- Facilitate processing by using web-enabled third party inquiry systems.

|

|

|

How NDS helps optimize your A/R operations?

- Fewer days spent in A/R (Accounts over 90 days are reduced on average by at least 5%).

- Better cash flow, fewer dollars lost thank to promptness in meeting timely filing guidelines.

- More attention to high-value, high-risk accounts.

- Fewer bad debt write-offs.

- Sufficient staff levels to minimize and prevent aged A/R buildup.

|