For many insurers and healthcare providers, methods of making payments and posting them to accounts have scarcely changed in decades: checks and EOBs are printed on paper, mailed, and manually deposited by the recipient. This expensive and time-consuming process can take 7-10 days and involves multiple processes, not to mention the additional costs of fulfillment and customer service.

There is a better way: NDS Payment Distribution Services.

NDS understands that for a payment solution to be effective, it has to provide attractive payment options for providers, and reduce payment delivery expenses for payers.

How it works?

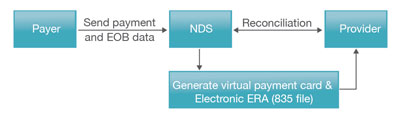

- NDS receives an electronic file with the entire payment details of providers for a given period, along with the corresponding EOB data.

|

|

|

- We use the information in that file to create a ’virtual prepaid card’ loaded with the exact amount of each payment. This virtual card is posted on a dedicated and secure web portal.

- Providers receive email notification of payments received. They log in securely to the web portal, find the virtual card, and use its number to have the funds transferred electronically to their bank accounts.

- EOBs are delivered in an electronic (835) format, which can be posted automatically to the provider’s accounting system.

|

That’s it: no checks to be printed, mailed or deposited, no requirement to provide status updates to customers, no manual EOB entry by providers’ staff. There is no software for anyone to install: the service is deployed over the web.

Benefits all around

Both payers and providers share the rewards of this streamlined, cost-effective solution.

Benefits to providers

- Receive payments faster electronically, in as little as few hours vs. 7-10 days by mailed check, with no risk of lost checks.

- Easy-to-use web portal interface.

- Eliminates the cost ($1.50 to $3.00 per claim) and bother of processing paper checks.

- Electronic EOBs are sent with each payment and automatically posted to your accounting system. There is no need to manually post, scan and store paper EOBs.

You can also consolidate payments by payer. You can use the portal and an electronic filing system to access and retrieve both payments and EOB history.

Benefits to Payers

NDS’ virtual prepaid debit card system turns your Accounts Payable into a new source of income by eliminating the recurring costs of printing, mailing and supporting paper-based payments

- We can work with your existing check print file, so there is no need for any change to your current claim payment platform.

- Our web portal can be accessed 24/7 for inquiries and reporting.

- We use a HIPAA and PCI certified Secure Payment Delivery system for delivery of ERAs and payments.

- No limit to the number of providers you can add.

Both parties can rest easy, knowing that all these process are protected by a sophisticated fraud detection system.

Quick implementation

We offer a flexible approach that can be designed around your specific needs and the needs of your providers to ensure the solution will be effective for you. Our team will work closely with you to implement a solution quickly and easily.

NDS’ ‘best of breed’ technology can provide you with the most advanced and complete electronic payment solution in the industry – which can be up and running in a very short time.